Navigating the Telstra 3G shutdown: how health businesses can stay connected

News

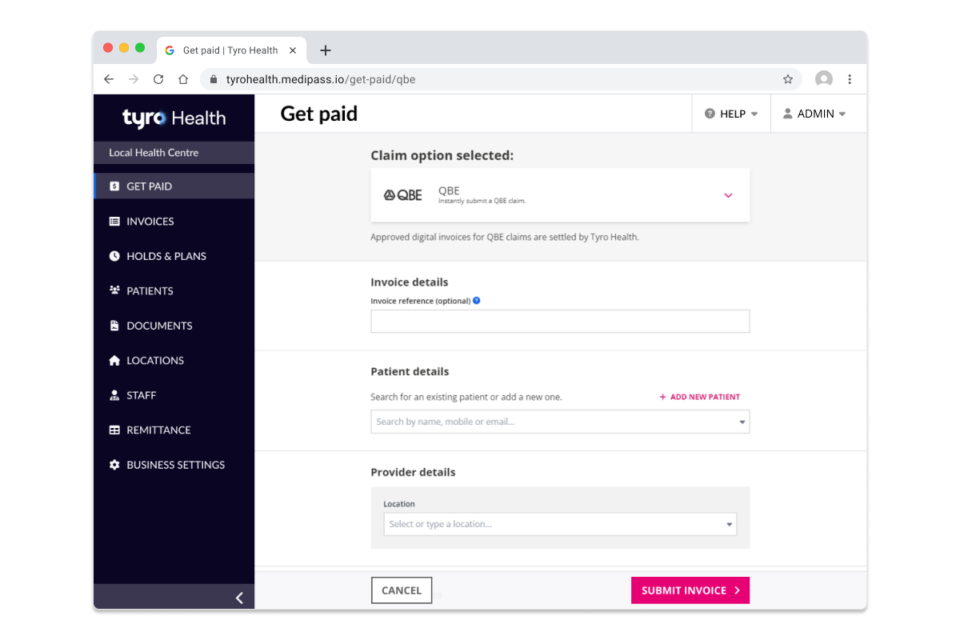

We are pleased to announce that Tyro Health is now integrated with QBE Insurance, enabling real-time invoice approvals and fast settlement of funds for providers raising invoices for NSW CTP claims.

This solution will enable healthcare providers to raise invoices directly with QBE and have these assessed. Approved payments are settled into the provider’s bank account within 24 hours. This advanced processing functionality increases transparency for providers and reduces their administration, enabling them to focus on treating their patients.

Providers can use Tyro Health Online, at no cost, and will be able to access this functionality via their existing integrated practice management software.

QBE joins a range of other insurers already integrated to Tyro Health Online, including icare NSW, Comcare, Worksafe Victoria, WorkCover Queensland as well as claiming solutions for Medicare, ECLIPSE, Private Health Insurance and NDIS.

QBE’s onboarding is another step towards our goal of making healthcare payments simple, to make healthcare more accessible for all Australians.

In the coming months, QBE digital invoicing will be available for QBE CTP claims in other states as well as workers compensation claims.

QBE Australia is part of the QBE Insurance Group, an international insurer and reinsurer. QBE offers a broad range of insurance products to personal, business, corporate and institutional customers, ranging from car and home insurance, to tailored business packages and specialist cover for industries such as aviation and farming.

QBE isn’t just about offering insurance. They’re all about the before and after – helping customers to protect and prevent against the ‘what ifs’ and being there to support of anything goes wrong.